At a Glance

Quilvest Capital Partners, part of the Bemberg Capital group, is a global investment manager focused on the middle market. As pioneers in the alternative investment industry, we take pride in our history, offering decades of experience deploying capital across various business cycles and environments. We operate four investment strategies.

Our Investment Strategies

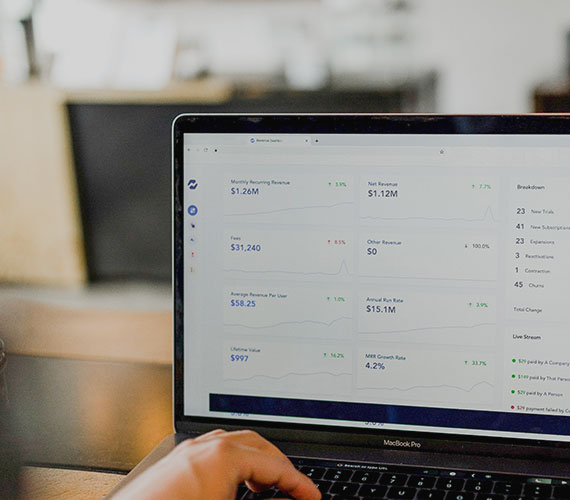

Key Facts

$7bn

AuM

50+

years of expertise in the private markets investment

400+

Limited Partners, institutions and family offices from 20+ countries

"We pride ourselves on being trusted partners in the global middle market. We have evolved into a leading global investment manager with a global presence, staying closely connected to local markets. We are dedicated to delivering value creation through our range of investment strategies"

Alexis Meffre

Chief Executive Officer, Quilvest Capital Partners

Our clients: We build long-term partnerships with sophisticated investors across the globe

We focus on understanding the needs of our clients and are able to offer investment opportunities that address their individual investment objectives.

Our first commingled programme dates back to 2002, and we continue to develop our product toolkit to help our clients construct portfolios that provide them with their desired balance of risk, return and liquidity. In addition to our discretionary investment programmes, we have the flexibility to create customised solutions tailored to specific investment needs and work collaboratively with our clients to define, implement and continuously refine their overall goals.

Our Investor Solutions & Capital Raising team is responsible for coordinating and driving all fundraising and client-servicing activities. The team works closely with all of Quilvest’s business lines to ensure strong alignment across the platform, and is constantly engaging with new clients to selectively broaden the investor base.

Pioneer

As a pioneer in private markets, many of our clients have invested with us across several generations of funds and our relationships are based on mutual trust and a deep understanding of our client’s requirements.

Alignment

Our heritage dates back more than a century to 1917, managing the wealth of our founding shareholder, the Bemberg family, which we continue to do today.

As the custodian of our founder’s wealth, we ensure we are fully aligned with all those across the globe who entrust us with their capital.

Global

We have a diversified, stable and global client base, which includes leading pension plans, sovereign wealth funds, insurance companies and family offices.

Sustainability

At Quilvest Capital Partners, we firmly believe that as a leading financial institution, we bear a responsibility towards society in effectively and responsibly managing the environmental and social impacts of our investment activities our investment activities' environmental and social impacts. Sustainability has consistently been integral to our firm, driven by the Quilvest family shareholding structure and DNA. As long-term investors, we aim to foster sustainable growth and value. Incorporating sustainability criteria into our decision-making process contributes to long-term returns and plays a significant role in preserving wealth. Read more.